Mastering Fibonacci Trading Strategies: Levels, Retracements, Extensions, and Expansions

Fibonacci trading strategies are powerful tools in a trader's arsenal, offering insights into potential price movements based on key Fibonacci levels. From retracements to extensions and expansions, understanding these strategies can enhance your ability to identify optimal entry and exit points in the market. In this comprehensive guide, we'll delve into Fibonacci trading strategies, covering Fibonacci levels, retracements, extensions, and expansions.

Fibonacci Levels:

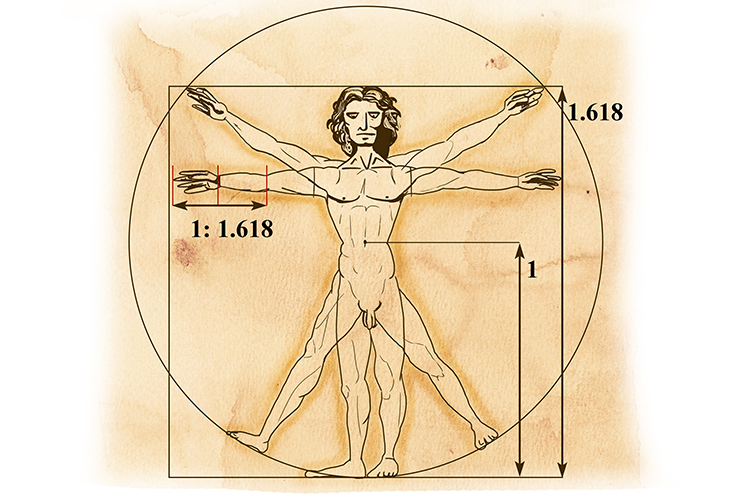

Fibonacci levels are based on the Fibonacci sequence, a mathematical concept where each number is the sum of the two preceding ones (0, 1, 1, 2, 3, 5, 8, 13, and so on).

These levels (such as 0.236, 0.382, 0.500, 0.618, etc.) are commonly used as potential support and resistance levels in trading.

Traders utilize Fibonacci levels to identify areas where price corrections or reversals may occur, aiding in setting profit targets and stop-loss orders.

Fibonacci Retracements:

Fibonacci retracements are a popular tool used to determine potential support and resistance levels during a trend.

Traders draw Fibonacci retracement levels from swing highs to swing lows (or vice versa) to identify potential areas of price reversal.

Common retracement levels include 23.6%, 38.2%, 50%, 61.8%, and 78.6%, which are believed to represent significant levels of support or resistance.

Fibonacci Extensions:

Fibonacci extensions are used to identify potential price targets beyond the current trend.

Traders draw Fibonacci extension levels from swing lows to swing highs (or vice versa) to project future price movements.

Common extension levels include 1.272, 1.618, 2.618, 3.618, and beyond, indicating possible areas where the price may extend in the direction of the trend.

Fibonacci Expansions:

Fibonacci expansions are similar to extensions but involve projecting potential price movements beyond a recent swing high or low.

Traders use Fibonacci expansion levels to anticipate where the price might reach after a significant price move.

These levels are derived from three points: the initial price move, a retracement, and the subsequent extension beyond the initial move.

Conclusion:

Mastering Fibonacci trading strategies can provide traders with valuable insights into market dynamics and potential price movements. By incorporating Fibonacci levels, retracements, extensions, and expansions into your trading toolkit, you can make more informed trading decisions and improve your overall trading success. Whether you're a beginner or an experienced trader, understanding and applying Fibonacci strategies can help you navigate the complexities of the financial markets more effectively.